Working with the monthly export price of salmon

Abstract

We

analyze the monthly export price of salmon time series which is available in

the astsa package of R. The data set is called salmon in the package. The

primary goal is to fit an appropriate SARIMA model to forecast future export

prices and to gain a better understanding of the periodic behaviour of the

series. From analyzing the ACF, I obtained evidence that the time series

exhibits seasonal behaviour of 12 months. In the end, an ARIMA(1,1,0)x(0,1,1)[12] model was chosen. Then I forecasted into the

future 10 months and found out that salmon prices increase overall in the next

10 months with a drop in price during the summer. From periodogram analysis, salmon

export price has a dominant periodicity of 36 to 45 months. We have evidence

that the export price of salmon has cyclical or periodic behaviour along with a

seasonal pattern.

Introduction

There has been so much fluctuation in

farmed salmon price over the years just like many other commodities in the

market. Main reasons include biological interferences such as sea lice

infestation and algal blooms. With rising demand in farmed salmon, farmers

cannot just simply produce more salmon because they are faced with these

biological interferences which may happen anytime. Other unwanted forces such

as severe weather conditions and diseases also contribute to the volatility of

salmon prices. So, one of the goals in this report is to deal with these random

shocks by modeling with moving average and autoregressive components.

Additional

research also shows that there is a growth cycle for salmon, which is they grow

faster and eat more during certain times of the year. Specifically, Norwegian

salmon fishing season is during the summer since the first weeks of June

produces the biggest fish. Thus, we will fit a SARIMA model that will capture

the seasonality aspect and random shocks of salmon prices. To do this, we will

utilize the salmon data set available in the package astsa in R. The data is

monthly export price of farm bred Norwegian salmon in US dollars per kilogram. A

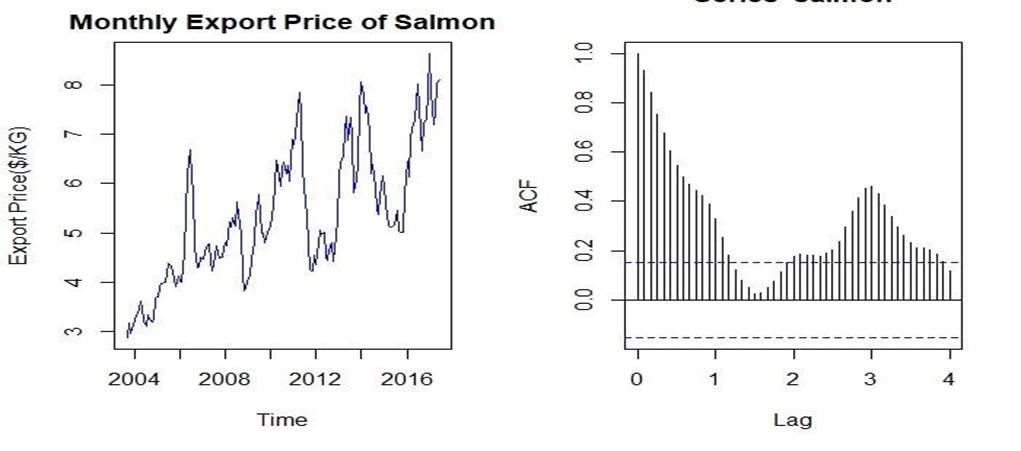

time series plot of this data is shown in Figure

1. As we can see, there is no obvious seasonal pattern, and this might be

because the seasonality is masked by the high volatility of salmon price. The

problem at hand will be to find the seasonality component in the SARIMA model

with appropriate MA and AR components that will give us a reasonable forecast.

Figure 1

Exploratory Analysis

As

shown by figure 1, there appears to be an upward trend in the export price of

salmon series which needs to be removed by taking the first difference. Also,

we can see from the ACF plot that the lag decays to 0 slowly which is an

indication that differencing is needed.

Additionally,

there appears to be some oscillation in the ACF which is indication of

seasonality. After detrending the data by taking the first difference, I

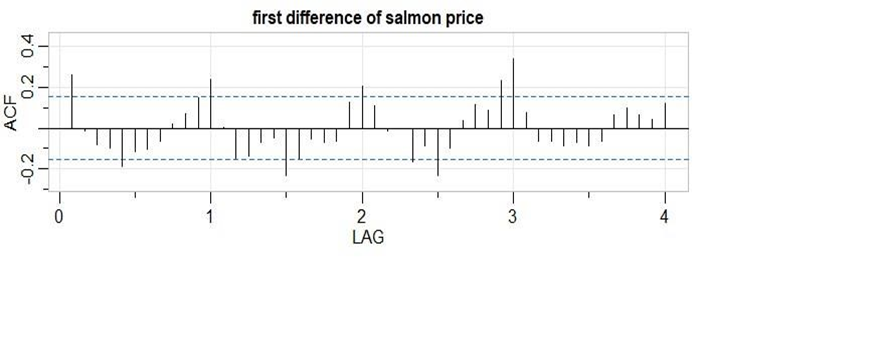

plotted the ACF of the first difference series (Figure 2) to show the seasonal component. We can see that there is

significant lag every 6 months since the black line exceeds the blue dotted

line. The significant peaks of the lag tend to occur every year and the

significant troughs also repeats itself after a year. Since seasonal

fluctuations occur every 12 months, a seasonal difference of 12 months should

be applied in addition to an ordinary difference. We also gain evidence here to

support our hypothesis that salmon prices indeed have yearly seasonal

behaviour.

Figure 2

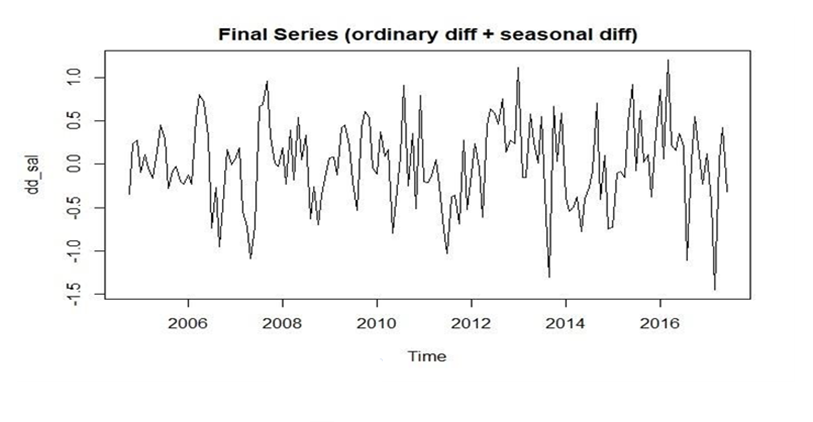

In total, I will apply a first ordinary difference to the

salmon series to get rid of the trend, and then I apply a seasonal difference

of 12 months because of seasonality shown in the above ACF plot. The final

transformed series after taking the two differences is shown in Figure 3. The transformed series does

not appear to have increasing variance, so we do not need any variance

stabilization and overall, it looks approximately stationary. Now we are ready

to identify the dependence orders for the SARIMA model using the ACF/PACF plot

of this approximately stationary series.

Figure 3

IDENTIFYING ORDERS OF SARIMA MODEL

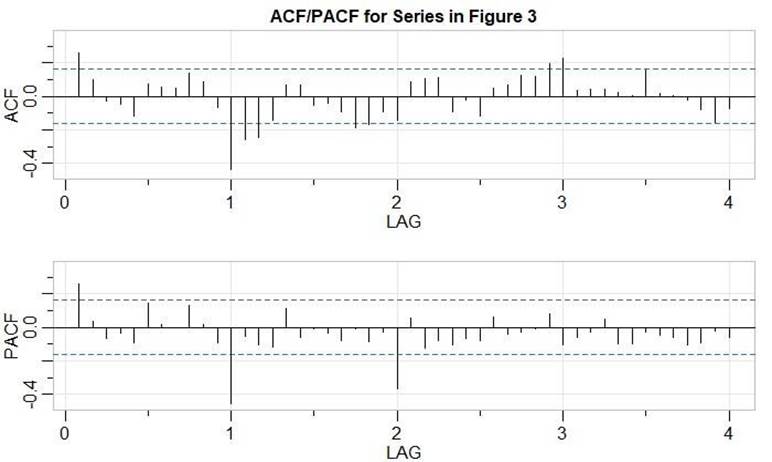

We have previously defined d = 1 and D = 1. We took first

ordinary difference (d = 1) and took a seasonal difference of S=12 months which

is represented by D = 1. Now that preliminary values of d and D are chosen, we

need to find (P, Q, p, q) by consulting the plot in Figure 4 below.

Figure 4

First

Proposed Model: It appears that

the ACF is cutting off at lag 12 which is 1*s where s = 12 and the PACF is

tailing off at lags 12k (k = 1,2,3...). This implies a seasonal MA(1) model which means P = 0 and Q = 1. S = 12 as

previously found. We see from the PACF at lower lags that there is a cut-off at

lag 1. Also, from the ACF, there is a cut-off at lag 1. This means we can

propose an AR(1) model or MA(1) model for the

non-seasonal component. Since salmon prices are seasonal which means there is a

period where the price is high and low afterwards, an AR(1)

model would make more sense since previous prices have a direct effect on the

future prices. We propose an AR(1) model for the

non-seasonal component. This means p = 1 and q = 0. Together, we propose an ARIMA(p = 1, d = 1, q

= 0) X (P = 0, D = 1, Q = 1)[S=12] model.

Second

Proposed Model: It appears that

the PACF cuts off at lag 24 which is 2*s where s = 12. The ACF is tailing off

at lags 12k (k = 1,2,3...). This implies a seasonal AR(2)

model which means P = 2 and Q = 0. For the non-seasonal component, before we

proposed an AR(1) model since the PACF at lower lag

cuts off at lag 1. Now we propose the alternative MA(1)

model since it can also be argued that the ACF cuts off at lag 1. So, the

second proposed model is ARIMA(p = 0, d = 1, q = 1) X (P = 2, D =

1, Q = 0)[S=12].

Fitting + Diagnosing the First Proposed Model: ARIMA(1,1,0)X(0,1,1)[12]

|

Parameter |

Estimate |

Standard Error |

T value |

P Value |

|

Non-Seasonal AR1 (ar1) |

0.2205 |

0.0791 |

2.7877 |

0.006 |

|

Seasonal MA1 (sma1) |

-0.7958 |

0.0828 |

-9.6097 |

0.000 |

Table

1: Parameter

estimates after fitting ARIMA(1,1,0)X(0,1,1)[12] on

salmon price.

Interpretation and Estimates of

Parameters:

From table 1, the AR parameter (ar1) estimate belonging to

the non-seasonal part is 0.2205. The seasonal moving average (sma1) parameter

estimate is -0.7958. We can interpret the sma1 parameter as follows; It is the

size of the effect on the export price of salmon based on a shock that happened

12 months ago. For example, the sudden emerge of Covid-19 led to many fishing

regulation and health concerns which may have affected salmon price a year

later. We can think of the ar1 parameter to be the direct effect on salmon

price based on the salmon price one month ago. The AR parameter estimate is

0.2205 which is a small direct effect on salmon export price based on salmon

price one month ago. For example, if export price was X last month, the effect

on the price this month is 0.2205X.

Testing the Significance of Parameter

Estimates: The p values in table 1 for both the seasonal MA (sma1) and non-seasonal

AR (ar1) parameters are very close to 0. It is less than the significance level

of 0.05 so we reject the null hypothesis that the parameters are 0. We conclude

that the parameter estimates are statistically significant.

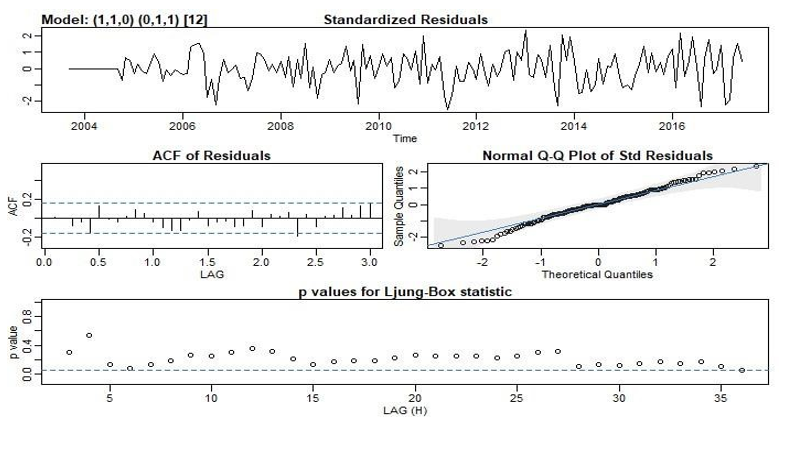

Diagnostics: The diagnostic plot for the model is

shown in Figure 5. The standardized residuals plot shows no obvious

pattern which is indication of independent white noise and that our model fits

well. However, there may be outliers exceeding 2 standard deviations in

magnitude when what we want is the standardized residuals having magnitude

around 1. The ACF plot of the standardized residuals show a significant spike

at lag 28 but one is not enough to be significant at 5% level. There should be

very little, if any, departure from the model assumption of uncorrelated

residuals. From the normal QQ-plot, the assumption that the standardized

residuals are normal is quite reasonable since there is little departure from

the blue line. There are a few outliers near the tails from the QQ plot but

overall, we can say the normality assumption is reasonable. We cannot claim the

residuals are independent because the p value for L-Jung box statistic is

significant at lag 36. Since lag 36 is a multiple of the seasonality of 12

months, there may be correlations that our model is not capturing. But our

model is not supposed to be perfect anyway.

Figure 5

Fitting + Diagnosing the Second Proposed Model: ARIMA(0,1,1)X(2,1,0)[12]

|

Parameter |

Estimate |

Standard Error |

T value |

P Value |

|

Non-seasonal MA1

(ma1) |

0.1609 |

0.0761 |

2.1139 |

0.0362 |

|

Seasonal AR1

(sar1) |

-0.6679 |

0.0745 |

-8.9648 |

0.0000 |

|

Seasonal AR2

(sar2) |

-0.4837 |

0.0734 |

-6.5869 |

0.0000 |

Table 2: Parameter estimates and info after

fitting ARIMA(0,1,1)X(2,1,0)[12]

Interpretation and Estimates of Parameters:

Table 2 gives the parameter estimates. The ma1

estimate can be interpreted as the size of the effect on the export price of

salmon based on a shock that happened 1 month ago. In this case the

"effect" is 0.1609 which is not that big. This is applicable to the

export price of salmon because of natural phenomena. For example, natural

disasters or new regulations on fishing may affect salmon price for a brief period of time and the effect gradually weakens. The

seasonal AR1 and AR2 parameters play a role in determining the salmon price

based on the salmon price 1 and 2 years ago. This may be unnecessary since

salmon price too long ago may have no effect.

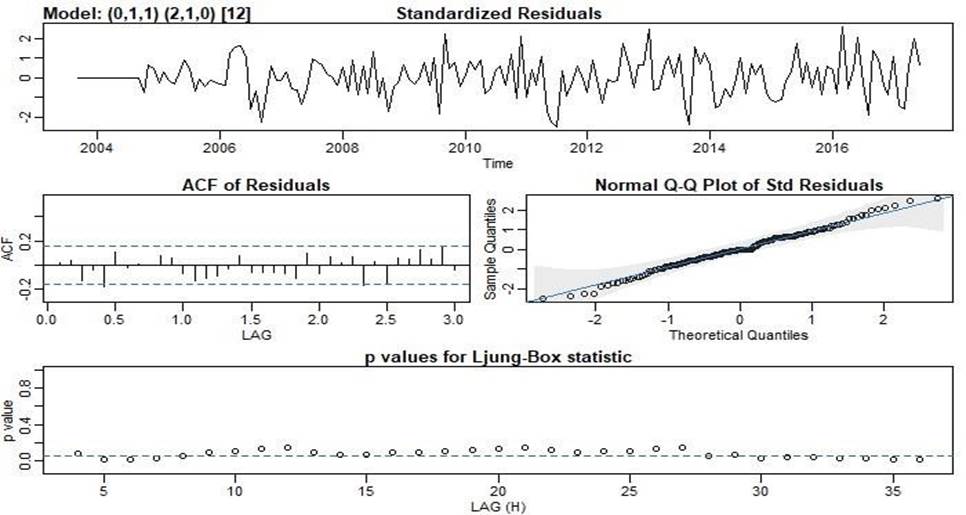

Figure 6

Diagnostics and Significance of

Parameters:

From table 2, the p values are all below the significance

level of 5% so we conclude that we have significant parameters. However, the

p-values for L-Jung Box statistic in figure

6 above are almost all significant. This means we reject the null

hypothesis that the residuals are independent. Since the residuals are not

independent, this model may not be the best fit compared to our first model

although the other diagnostic plots like normal QQ-plot looks fine.

Model Selection

The second model is more complicated

since it has two seasonal AR parameters, but it also performs worse based on

its p values in L-Jung Box statistic. It does not satisfy the model assumption

because its p-values in L-Jung statistic is significant. So, its clear that we

should choose the more parsimonious model, which is ARIMA(1,1,0)X(0,1,1)[12].

Now we forecast using this selected model.

Forecast Using Selected Model

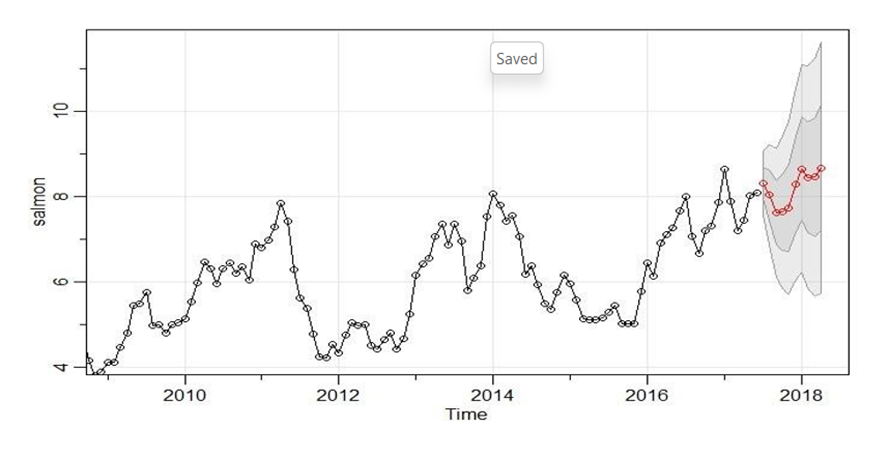

Using ARIMA(1,1,0)X(0,1,1)[12],

I will forecast the salmon export price in the next 10 months. A plot of the

forecast of the salmon export price in next 10 months is given in Figure 7 below. Overall, salmon price

is predicted to increase over the next 10 months with a price drop during the

June summer period. The prediction intervals of the forecast are also

increasing as time progresses which means there is more uncertainty of salmon price

if we look far into the future. There are many reasons why the price is so

unstable, such as sea lice, algal blooms and other biological factors that can

interfere with health concerns. As a result, its hard to forecast salmon price

too far into the future and hence the large prediction intervals. Prediction

intervals are given in Table 3.

Figure 7

|

Future Week |

Forecast |

Lower

Bound of PI |

Upper Bound of PI |

|

1 |

8.319999 |

7.590998 |

9.049001 |

|

2 |

8.036586 |

6.886329 |

9.186842 |

|

3 |

7.618651 |

6.142490 |

9.094812 |

|

4 |

7.637292 |

5.891085 |

9.383498 |

|

5 |

7.731674 |

5.751107 |

9.712241 |

|

6 |

8.283610 |

6.093459 |

10.473761 |

|

7 |

8.653043 |

6.271650 |

11.034436 |

|

8 |

8.454772 |

5.896386 |

11.013158 |

|

9 |

8.459431 |

5.735527 |

11.183335 |

|

10 |

8.671351 |

5.791426 |

11.551276 |

Table 3: Future 10 weeks forecast and its 95%

prediction intervals

Spectral Analysis

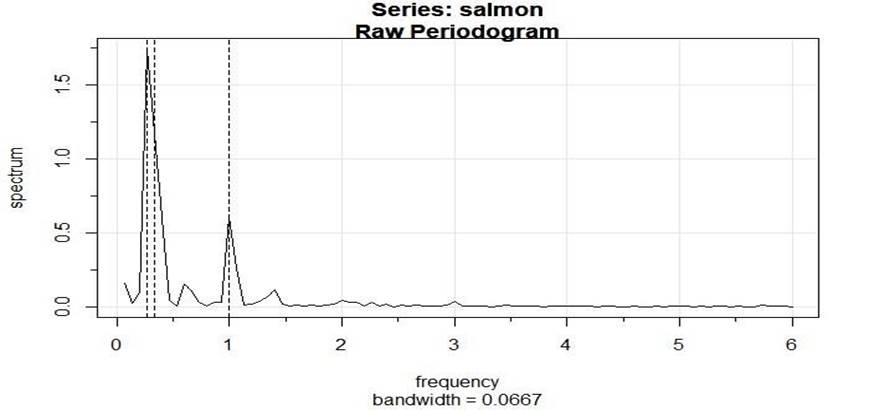

We will now understand the periodic behaviour of salmon

prices using spectral analysis. I performed a periodogram analysis and found

that the first three predominant periods are 45 months, 36 months,

and 12 months. Figure 8 shows the three dominant frequencies. The 95% confidence

interval for the predominant period of 45 months is (0.4727, 68.8742) which is

very wide so its hard to interpret. However, we see that the lower bound is

0.4727 which is higher than most other periodogram ordinate, so this peak is

significant. We can also establish significance for the period of 36 months.

Since the confidence interval for it is (0.3171, 46.2026), the lower bound of

0.3171 is higher than most other periodogram values so it is also significant.

However, we cannot establish significance for the predominant period of 12

months. Its confidence interval is (0.1647, 23.99) which is wide in the first

place. But unlike the other two confidence intervals, its lower bound is way

too low to establish significance. Some other lower peaks are included in this

interval because 0.1647 is not high enough to exclude them which means this

peak is not significant. Combining the results, there

appears to be a dominant periodicity of

about 36 - 45 months since we were able to establish significance for those

periods.

Figure 8

Discussion

As mentioned in the introduction, there is a yearly seasonal

pattern in the price of salmon because Norwegian salmon are the biggest during

the summer, so the supply chain is increased. We have evidence of this result

as forecasting 10 months show that the price decreases over the summer period

and goes back up when the next year begins. From spectral analysis, we also

found that the salmon price has periodicity of about 3 to 4 years in addition

to its seasonality. However, our model does have limitations because we

observed the significant L-Jung p value at lag 36 in figure 5 and the normal

QQ-plot has some outliers. This means our model is not capturing all the

patterns of salmon price. There may be multiple seasonality that our model

cannot capture because it requires more advanced models. For example, our model

has seasonal lag of 12 because summer is the season for catching Norwegian

salmon but there could be other seasonal patterns such as daily or monthly

pattern that we are simply unaware about and which our model is not doing very

well in capturing this relationship.